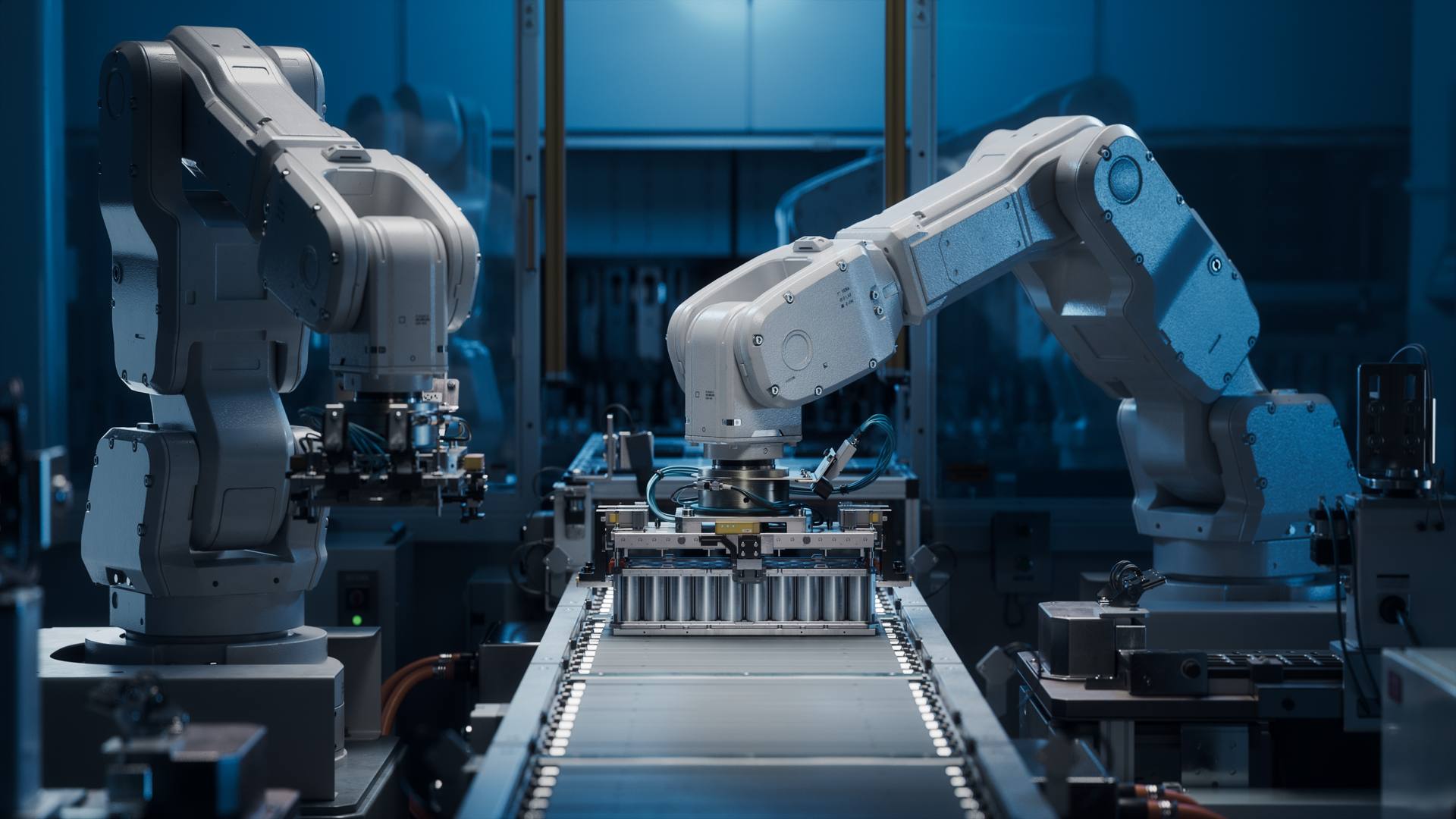

Toyota has announced it will be investing $1.4bn in its Indiana plant, to help increase advanced EV production. This is another example of Toyota underpinning its ambition to expand in the BEV market. This plant’s assembly infrastructure will be upgraded alongside a new battery pack assembly line. This investment also will create c340 new jobs in the region and further reinforce its commitment to the Indiana region, to carry on its 30+ year relationship.

CATL and Beijing Hyundai have announced they have signed a strategic partnership agreement with each other that will focus on powering Beijing Hyundai EVs with CATL batteries. This agreement further strengthens the relationship between the two, as they have worked together in some capacity since 2017 around shared product development. Bear in mind Beijing Hyundai is a JV between BAIC Motor and Hyundai Motor Company. In the coming days/weeks, Beijing Hyundai is set to unveil over 10+ global (EV) models equipped with CATL's latest battery technology.

Go-Ahead has announced it is partnering with Tranzaura, an end-to-end digital platform for the transport industry. Tranzaura focuses on digitising and streamlining compliance tasks, such as maintenance checks. This partnership is initially for 5 years as Go-Ahead looks to move away from paper-based records. This solution is already being used in its London depots and will be rolled out across all its UK operations in the coming weeks and months. Tranzaura’s app will give management teams real-time compliance insights and visibility using photo capture and real-time communication tools.

Honda and Asahi Kasei have signed a preliminary agreement to collaborate on manufacturing battery separators for EV batteries in Canada. Both companies are aiming to formalise a JV by Q4 24 to produce battery separators. It is interesting to see how different OEMs are tackling to firm up their battery supply chain(s). Separators play a critical role in preventing short circuits in lithium-ion batteries; thus, Asahi will leverage its advanced material technologies whilst Honda will leverage its electrification insights to manufacture separators for EVs. It is important to highlight that OEMs forecast the demand for EVs in North America will significantly increase in the coming years. Recent media conjecture has been highlighting the topical volatility in EV adoption in North America, however (RVs aside, which will normalise in due course) the majority of the different agents in the supply chain(s) are heavily investing capital in the infrastructure needed to help ramp up zero-emission vehicle adoption in the coming years.

Wrightbus has received a follow-up order from the German government to supply 46 hydrogen buses. These buses will be delivered to Cottbusverkehr (a German municipality) and used in the city of Cottbus. These 46 Kite Hydroliner vehicles are pencilled in to be delivered at the end of Q4 24. This is a significant order for the city and operator, as it will be the operator’s first hydrogen buses to operate in and around the city. Bear in mind, the German government recently announced a €350m support package to help stimulate the production of renewable hydrogen.

CATL has announced it will start small-volume production of all-solid-state batteries by 2027. This is a significant announcement as this is the first time a timetable has been articulated to the market. All-solid-state batteries are excellent in terms of energy density and safety and have great potential, with energy density expected to reach 500 Wh/kg. Currently, the energy density of liquid lithium batteries can reach 350 Wh/kg and it appears that is the ceiling for liquid lithium batteries. Bear in mind, that the R&D that has/is going into all-solid batteries has been challenging and time-consuming, as CATL has had to coordinate with various parties such as the battery industry chain(s) and universities. Thus, it is encouraging to see that effort is paying off, as CATL has announced this provisional timetable.

Rhodium Group, a superb independent research provider, has published a fascinating report indicating that the EU will need to impose tariffs of 40-50% to curb imports of Chinese EVs. To recap, last year the EU launched an anti-subsidy investigation into Chinese EVs and is weeks away from announcing its results and consequently any punitive action(s). Rhodium’s analysis suggests that any punitive action below 50% would be inconsequential and it predicts that EU policymakers might have to use other methods to protect its domestic industry. Methods such as restricting Chinese imports on security grounds (which we believe is unlikely due to potential retaliation) or focusing on creating subsidies aimed at EU-made EVs.

Kia UK has announced it will start a new nationwide campaign, Discover EV with Kia, to help educate (potential) customers. Potential customers can book appointments and will be given information on topics such as EV battery life, charging time, and charging in public, by a Kia EV expert. This campaign has been launched, in part, as there is a great deal of misinformation surrounding EVs and the UK Kia dealerships aim to help dispel EV myths and educate the public on EVs. This is a good initiative which aims to empower potential customers who are thinking about transitioning to an EV.

Deals

Treefera, an AI-enabled data management platform focussing on nature-based asset reporting, has raised $12m in a Series A funding round, led by AlbionVC. Currently, this startup utilises satellite and drone images to map the world’s forests and in time it will start mapping out kelp and algae blooms. Potential customers would use this data when working on projects to prevent deforestation or to promote reforestation. The startup intends to use the capital to expand its team and to further develop its platform.

Terra One, a Berlin-based battery storage startup, has raised $7.5m in a seed funding round, which PT1 led. Interestingly, this startup is looking to remedy the inefficiency of the (German) energy grids. Last year Germany lost 19 terawatt hours of energy, which is enough to power 6 million households, due to grid congestion. Terra One’s solution is to store renewable energy generated during periods of low demand, which is then released to the grid when demand is high. The startup will not be producing batteries in-house but rather buying lithium-ion batteries from OEMs such as Tesla or CATL. The startup uses an AI model which analyses market trends and supply & demand to decide when the optimal point is to charge the battery and when to discharge it. The startup will use the capital raised to expand its team (especially for engineers and project finance experts) and to develop its AI software.